Process of Startup India Registration in India

The Government of India launched the Startup India scheme in 2016. The primary objective of this scheme is to promote the growth of start-ups in India. Under this scheme, the government has taken several important steps to build a strong startup ecosystem and make India a job seeker country instead of a job seeker. The Department of Industrial Policy and Promotion (DPIIT) manages the programs under the Startup India scheme.

Startup India registration process has widened the scope of development by creating employment opportunities in the Indian economy.

A startup is a recently established business, usually small, that is started by a single or a group of people. What sets it apart from other new organizations is that a startup provides another item or service that is not being offered similarly anywhere else. The aim is innovation development.

Startup India Registration You need to know What Is a Startup?

A startup is a recently established business, usually small, that is started by a single or a group of people. What sets it apart from other new organizations is that a startup provides another item or service that is not being offered similarly anywhere else. The aim is innovation development.

Any company having the following facilities comes under the category of Startup and is also eligible to avail of the benefits of DPIIT

Age of the company

The date of incorporation of the company should not exceed 10 years.

Company Type

Either your company is a Private Limited Company under the Companies Act, 2013 or registered as a Partnership Firm under the Indian Partnership Act, 1932, or as a Limited Liability Partnership Firm under the Limited Liability Partnership Act, 2008.

Turnover Limit

The company should have an annual turnover that should not exceed Rs.100 crores for any financial year since its incorporation.

New business unit

The business should be new and should not be a result of a split or reorganization of an already existing business.

Innovation Friendly

Startups should work towards innovating or developing new products or services or improving an existing ones. The business model should be of immense potential for the purpose of wealth creation and job creation.

DIPP Certificate

It is invariably necessary to obtain a certificate from the Inter-Ministerial Board; The board has been established by DIPP (Department of Industrial Policy and Promotion).

What are the Benefits of DPIIT

After creating a profile on the website for Startup India, the next step is to get accreditation from the Department for Promotion of Industry and Internal Trade (DPIIT). This accreditation helps startups to gain benefits which include access to high-quality intellectual property services and other resources, easy winding up of the company, the benefit of self-certification under environmental and labor laws, reduction in public procurement norms, and funds up to Rs. Access is included. Fund, tax exemption for three consecutive years, and tax exemption on investments above fair market value.

DPIIT-registered companies can avail of the following benefits provided under the Startup India Registration Scheme:

- Simplification and Handholding

With much easier compliance and exit procedures for failed start-ups, legal aid has also become viable and accessible.

- grants and incentives

An exemption is provided on income tax and capital gains tax, apart from raising funds to infuse more capital in startups.

- Incubation and Industry-Academia Partnership

Developing a number of incubators and innovative laboratories, events, competitions, and grants.

What are the Benefits of Startup India Registration?

The various benefits of getting registration for Startup India are mentioned below:

The Government of India provides many benefits to start-ups working under the umbrella of the Startup India program. The list of benefits provided under the Startup India Registration Scheme is written below:

- Tax benefit

Startups operating under the Start-Up India Registration Scheme can avail of the exemption for up to three years. Income tax exemption benefits are available under section 80IAC and section 56 for angel tax relief.

- tender participation

Government and PSUs give discounts for startups in various tenders. They are allowed to participate in public procurement work through tenders. Other benefits include relaxation in criteria for previous experience, EMD, or turnover.

- Government grant opportunity

Through the Alternative Investment Fund, the government has allocated Rs 10,000 crore for investment in startups. This fund is managed by SIDBI. All startups are eligible to apply under this quota.

- Participate in various government schemes

Various government schemes are released day by day by the government to motivate startups to participate. For example raw material assistance, permanent finance scheme, bank loan facility, etc.

- Start-ups to participate in grand challenges

Reputable companies motivate startup entrepreneurs and encourage them to participate in delivering business solutions. This gives startup entrepreneurs an opportunity to participate in the scheme and earn more money. Recently, these reputed companies like WhatsApp, Aditya Birla, Mahindra, and many others have joined start-up enterprises to organize financial assistance schemes.

- Easy winding up

The process of winding up of company becomes easy and it takes 90 days to wind up under the insolvency & bankruptcy code 2016

- Connect Networks

The advantage of a startup is that it helps companies to network and seek larger connections. These startup companies search for various big companies and join them for the purpose of getting mentorship. Relationships with investors and industries are really beneficial for startup ventures.

- Self – Certification

Startups take advantage of self-certification of compliance with various labor laws and nine environmental laws.

- Patent exemption

Startups operating under the Startup India Registration Scheme will get a discount of 80% at the time of filing the patent application.

- Exemption in the filing of a trademark

The government assures a 50% discount on trademark filing to the start-ups working under this scheme.

- business opportunities

Startup India is a platform that gives many opportunities, recognition, and support to all the start-ups who are working hard to carve a niche for themselves.

Documents required For Startup India Registration

- Registration certificate

- You are required to upload the Certificate of Incorporation of your Company/LLP (Registration Certificate in case of Partnership)

- Email ID and mobile number with contact details

- Details of the company which will include industry, the scope of work, category of dealing, registered office address, etc.

- Proof of concepts like pitch deck, video, and website link in terms of initial traction and verification.

- Details about the directors or partners associated with the company including their name, photo ID, gender, contact number, email id, and address)

- Details of authorized representatives (name, contact details, designation, email id)

- Revenue model and product exclusivity.

- PAN details

- A Brief Description of Business – Provide a quick description of the innovative nature of your business.

Eligibility For Startup India Registration

The organization to be created must be a private limited organization or a limited liability partnership.

- The enterprise has not completed a period of ten years from the date of incorporation or from the date of registration.

- The annual turnover of the enterprise did not exceed 100 crores for any financial year since its incorporation.

- The enterprise must work towards the development, innovation, or improvement of services or processes with the aim of generating employment or generating wealth.

- The most important eligibility condition is that the startup venture should not be formed by reconstruction or divestment of any already existing business.

- The companies should have got approval from the Department of Industrial Policy and Promotion (DIPP).

- To get approval from DIPP, the firm should be backed by an incubation fund, angel fund, or private equity fund.

- The company should have got a backing guarantee from the Indian Patent and Trademark Office.

- It should contain an offer letter by incubation.

- Capital growth is kept out of income tax under the Startup India scheme.

- The firm should offer innovative ideas, products, or services.

- Angel Funds, Incubation Funds, Accelerators, Private Equity Funds, and Angel Networks must be registered under SEBI (Securities and Exchange Board of India).

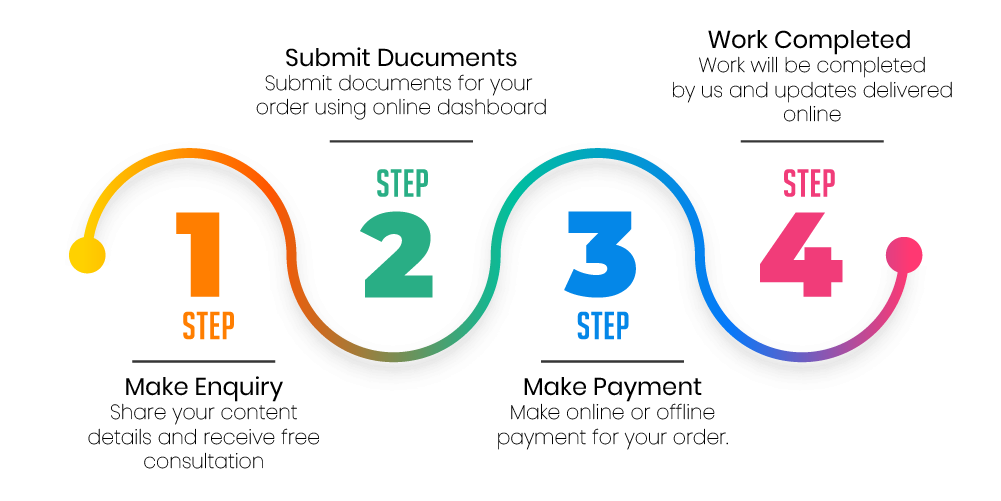

Process of Startup India Registration

To register under the Startup India scheme a business needs to cover the steps mentioned below.

- business incorporation stage

This progression is for organizations that are neither incorporated nor registered as proprietors of a business organization.

It is mandatory to register as a Private Limited Company or Limited Liability Partnership or Registered Partnership Firm.

However, no additional registration steps are required under the Startup India program while incorporating any of the business forms mentioned above.

- Start Startup India Registration Process

The Startup India Registration process is available online. The applicant can carry out the process of registration by visiting the website of the Startup India Scheme.

1. Startups are required to register their company in the “Shram Suvidha Portal”, a portal owned by the Ministry of Labor and Employment.

2. Register on Shram Suvidha Portal and then log in.

3. Once you are logged in, “Are any of your establishments a startup?” Click the link.

4. Follow the instructions to get registered.

Also, it is mandatory for startups to fill up forms related to business operations and future goals.

- Get DPIIT Accredited

After creating a profile on the Startup India website, the enterprise is required to get accreditation from DPIIT. This recognition is helpful for enterprises to avail benefits like access to standard quality intellectual property services etc.

- Recognition Application –

The next step will be to fill out the startup recognition form and click on submit.

- Submit documents for registration.

- Other details about the startup in a nutshell

Startups are required to submit a brief description of the activities in which their business is involved, i.e. product/service or both. They must provide information that proves their business is innovative.

Make sure your business is comprehensively and innovatively involved in solving a problem or working to improve an existing service or product.

To promote and support the startup ecosystem in India, the Government of India has launched the Startup India program. The registration process of Startup India is also easy and rational.

Frequently Asked Questions

What is the primary objective of the Startup India scheme?

The primary objective of the Startup India scheme is to promote the growth of start-ups in India. Under this scheme, the government has taken several important steps to build a strong startup ecosystem and make India a job seeker country instead of a job seeker.

What are the benefits of DPIIT?

- Simplification and Handholding

- funding and incentives

- Incubation and Industry-Academic Partnerships

What are the steps to be followed to register a startup under the Startup India scheme?

Startup India registration process is available online. The applicant can carry out the process of registration by visiting the website of the Startup India Scheme.

- Startups are required to register their company in the “Shram Suvidha Portal”, a portal owned by the Ministry of Labor and Employment.

- Register on Shram Suvidha Portal and then log in.

- Once logged in, “Are any of your establishments a startup?” Click the link.

- Follow the instructions to register.

Who can register with Startup India?

Private Limited Companies, Partnership Firms,s or any organization registered as Limited Liability Partnerships can register them under Startup India Scheme.

What type of business structure should I choose for my startup?

The most preferred business structures for startups are private limited companies and LLPs. A Private Limited Company is legally recognized and often backed by investors.

What is the difference between an accelerator and an incubator?

Startup incubators are typically organizations that help business people build their businesses, especially those in the underlying stages.

Startup accelerators strengthen start-up and growth-driven organizations.

How long is a company recognized as a startup?

Any business organization which has completed 10 years from the date of its registration, and the previous year’s turnover has crossed 100 crores, will cease to be a startup on completion of 10 years from the date of its registration/joining.

How do I know that my registration is complete?

When the application is terminated, and the startup has received recognition, you will receive a system-generated certificate of recognition. You will have the option to download this testament from the Startup India portal.

Can an existing entity register itself as a startup?

Indeed, by law, an existing organization can register itself as a startup, given that it meets the recommended standards for startups. They will also have the option of availing different fees and IPR benefits which are accessible to new companies.

Why do investors invest in startups?

Resource investing in a startup is an unsafe recommendation, yet the low capital requirement coupled with high upside potential makes it worthwhile for investors to fund their investments in new companies.

Do I need to print an application form and submit a physical copy to complete the process of startup registration?

No, the application has to be submitted online only.

Once my registration is successful, can I get a certificate for the same? If yes, will I be able to download the certificate?

Yes, once the registration is successful, it is possible to download the system-generated verifiable certificate of recognition.

For your Startup India Registration Choose LegalTax Over any other Organizations

- Because of our good services, we have five-star Google reviews.

- We have an amazing team of 100+ experts who give their best services.

- We are incorporating a large number of companies.

- As we give one of the best services across India, there are around 3000+ registrations happening every month.

- We have around 10+ years of startup-focused legal expertise.

- We also provide the best mobile app facility

Related Articles

- Step-by-step process for Incorporation of Company in India

- Company Registration in Delhi

- How to register one person company

- Documents Required for One Person Company

- All you need to Know About Partnership Firm Registration

- How to register proprietorship firm in India?

- Thing that you should know about section 8 companies

- Let’s Understand the Concept of LLP and its tax Implications