New GST Registration Online

Businesses with an annual revenue of more than Rs. 40 Lacs are required to register for GST. GST registration online is mandatory for particular businesses such as Export and Import, E-commerce, Casual Dealers, and also the Market Place Aggregator. Carrying out business without GST registration is considered as an offense.

- Get Free Advisory by a CA

- Guidance on how to raise an invoice

- GST Return filing

- GST Registration in 3 days

GST Registration Online - Process, Documents Required, Fees & Limit

An overview of New GST Registration

GST is an abbreviation for Goods and Services Tax, which is an indirect tax placed on the supply of goods and services in India. GST was introduced in 2017 as a landmark reform to replace the multiple taxes and cesses that were imposed by the Central and State Governments. GST aims to simplify the tax system, eliminate cascading effects of taxes, widen the tax base, and improve compliance.

GST is based on the principle of destination-based taxation, which means that the tax is collected by the State where the goods or services are consumed, rather than where they are produced or supplied. GST is also a value-added tax, which means that the tax is levied only on the value added at each stage of the supply chain, and not on the entire value of the transaction.

GST Registration Online is also required for certain persons who are liable to pay tax under reverse charge mechanism, such as importers, recipients of services from unregistered suppliers, or agents of suppliers.

What Is GST Registration?

GST registration is the process of obtaining a unique identification number from the government for any business entity that is liable to pay Goods and Services Tax (GST) on its supply of goods or services. GST registration is mandatory for certain categories of businesses, such as those with an annual turnover exceeding Rs. 40 lakhs, those engaged in inter-state trade, e-commerce operators, non-resident taxable persons, etc. GST Registration Online enables a business to avail various benefits under the GST regime, such as input tax credit, seamless flow of credit, compliance rating, etc. New GST Registration also helps in preventing tax evasion and ensuring a transparent and accountable tax system.

What is GSTIN (Goods and Services Tax Indication Number)?

GSTIN is a unique identification number assigned to every registered taxpayer under the Goods and Services Tax (GST) regime in India. It is a 15-digit alphanumeric code that contains information such as the state code, the PAN of the taxpayer, the registration number, the entity code, and the checksum digit. GSTIN is used to track the tax liability and compliance of taxpayers, as well as to facilitate the filing of returns and payment of taxes online.

Mandatory Documents for GST Registration:

To apply for GST Registration Online, the business entity needs to submit certain mandatory documents along with the online application form. The documents required vary depending on the type and nature of the business entity. However, some common documents that are required for all types of entities are:

- PAN card of the business entity or the applicant (proprietor, partner, director, etc.)

- Aadhaar card of the applicant

- Proof of business address (such as electricity bill, rent agreement, property tax receipt, etc.)

- Bank account details (such as cancelled cheque, bank statement, passbook, etc.)

- Digital signature or E-signature of the applicant

- Valid email address and mobile number for verification and communication

- Partnership deed or LLP agreement for partnership firms or LLPs

- Certificate of incorporation, memorandum of association and articles of association for companies

- Letter of authorization or board resolution for authorized signatory

- GSTIN or provisional ID of the existing taxpayers under the previous tax regime

- Proof of major place of business and a second location

- Details and proof of constitution of business (such as trust deed, society bye-laws, etc.)

Depending on the type of entity, some additional documents may be required, such as:

The applicant should ensure that all the documents are scanned and uploaded in PDF or JPEG format and do not exceed the file size limit of 1 MB. The applicant should also ensure that all the information and details provided in the application form are accurate and complete. Any discrepancy or error may lead to rejection or delay in the processing of the application. The applicant can track the status of the application Online GST Registration using the acknowledgement number generated after submission.

Who Should Apply For New GST Registration Online?

GST Registration Online is mandatory for certain categories of taxpayers, such as:

- Businesses or individuals who supply goods or services in India and have a turnover of more than Rs. 40 lakhs in a financial year (Rs. 10 lakhs for special category states)

- Businesses or individuals who are involved in inter-state trade or commerce of goods or services.

- Businesses or individuals who are required to pay tax under reverse charge mechanism.

- Businesses or individuals who are agents or intermediaries of suppliers or recipients of goods or services.

- Businesses or individuals who are e-commerce operators or aggregators.

- Businesses or individuals who are liable to deduct tax at source (TDS) or collect tax at source (TCS)

- Businesses or individuals who are engaged in the supply of online information and database access or retrieval (OIDAR) services to a non-taxable online recipient.

- Businesses or individuals who are non-resident taxable persons or casual taxable persons.

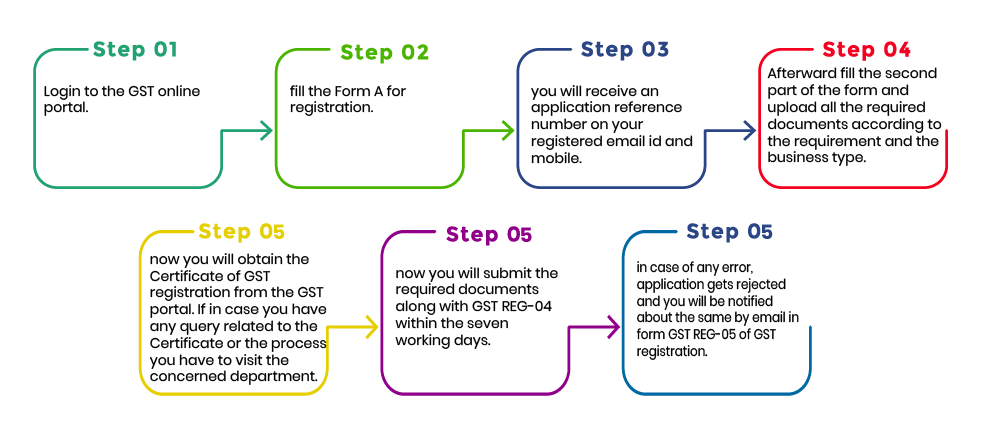

New GST Registration Process in India

Following steps has to be followed for New GST Registration:

- Determine the type of GST registration applicable to your business.

- Collect the required documents and information for the registration process.

- Visit the GST Registration Online portal and fill out the online application form.

- Verify your details using Aadhaar authentication or EVC.

- Submit the application and receive the acknowledgment number.

- Wait for the approval of your GST registration and the issuance of your GSTIN.

Online GST Registration Process for New Business

- Visit the official GST portal and click on Services > Registration > New Registration.

- Select the Taxpayer category as Regular, Composition, Casual Taxable Person, etc. and fill in the details such as legal name, PAN, email and mobile number.

- Verify the email and mobile number using the OTPs sent to them and receive the Temporary Reference Number (TRN).

- Login with the TRN and complete the application form by providing information such as business address, bank account, authorized signatory, etc.

- Upload the required documents such as proof of identity, proof of address, photographs, etc. depending on the type of business entity.

- Submit the application using a digital signature (DSC) or an Aadhaar-based electronic verification code (EVC).

- Receive the Application Reference Number (ARN) on the registered email and mobile number and track the status of the application on the GST portal.

- Once the application is approved, download the GST registration certificate from the portal.

Types Of GST Registration Online:

There are primarily two types of GST Registration Online that can be done online:

1. Regular GST Registration:

Most firms that are mandated to register under GST are subject to regular GST registration. This form of registration is appropriate for firms that offer goods or services inside a state or across many states in India. The following are the essential steps in the normal GST registration process:

- Navigate to the GST online portal: The applicant must go to the government-designated official GST portal.

- Complete the Online GST Registration application form as follows: The applicant must supply pertinent information such as the legal name of the company, address, PAN (Permanent Account Number), bank account information, and contact information. Documents such as the business owner's PAN card, identification, and address proof are also required, and proof of business registration may also be required.

- Submit your application and get your Application Reference Number (ARN): An Application Reference Number (ARN) is produced once the application form is completed and submitted. This number can be used to track the application's progress.

- Verification and processing: The application is verified by the GST authorities, who examine the given information and documentation. If everything checks out, the GST registration is accepted, and the firm receives a GSTIN (GST Identification Number).

2. Composition Scheme GST Registration:

The Composition Scheme is an alternate and streamlined way of GST tax payment. It is intended for small enterprises with low turnover. Businesses that are registered under the Composition Scheme pay less tax and have fewer compliance obligations. Here's how the Composition Scheme's online registration works:

- Log in to the GST portal: The applicant must log in to the official GST portal, just like with standard GST registration.

- Complete the Composition Scheme application: The applicant must supply the necessary information, such as the legal name of the business, address, PAN, bank account information, and contact information. Documents proving the company owner's identity and address may also be requested.

- Submit your application and get your Application Reference Number (ARN): An Application Reference Number (ARN) is generated once the application form is submitted, allowing the applicant to trace the status of the application.

- Verification and processing: After the application is verified, the Composition Scheme registration is accepted if everything is in order. The company will be given a GSTIN and will be eligible for the Composition Scheme advantages.

Benefits Of Online GST Registration:

There are several benefits of online Goods and Services Tax (GST) registration. Here are some key advantages:

- Convenience: Applying for GST Registration Online allows you to do it from anywhere and at any time if you have an internet connection. You don't have to go to a physical office or wait in huge lines, which saves you time and effort.

- Timesaving: Generally, the online registration process is speedier than the old offline technique. You can save time by completing the application and submitting the relevant papers electronically.

- Paperwork reduction: Online GST Registration considerably lowers paperwork. Instead of dealing with actual documents, you may digitally upload them, making it easier to maintain and organise your data.

- Real-time status updates: You may watch the progress of your application in real time with online registration. At each stage of the registration process, such as application submission, verification, and approval, you will get updates.

- Transparency: Because all information and papers are supplied electronically, the Online GST Registration procedure is transparent. This reduces the likelihood of mistakes or inconsistencies and fosters responsibility.

- Access to information: Online registration systems frequently give access to a multitude of GST compliance-related information and resources. FAQs, user manuals, and other instructional materials are available to assist you better understand GST rules and regulations.

- Integration with other systems: To expedite your compliance operations, Online GST Registration solutions may be coupled with other government systems such as tax filing websites. This connection might help you save time and eliminate mistakes in manual data entry.

- Simple amendment and update: If you need to make changes or adjustments to your New GST Registration information, you may do it quickly and easily using online registration. Through the web portal, you may update your company's profile, address, contact information, and more.

- Remote area accessibility: Online registration guarantees that enterprises in remote or rural locations have the same access to GST registration as those in metropolitan areas. It does away with the requirement for physical presence, making the registration procedure more inclusive.

- Cost-effective: Online GST Registration can be cost-effective compared to the traditional offline process. It eliminates the need for physical travel, reduces paperwork, and streamlines the overall registration process, potentially saving you money.

FAQ's

- PAN card of the applicant

- Aadhaar card of the applicant

- Proof of business address (for example, a lease agreement, an electricity bill, etc.)

- Bank account details and cancelled cheque

- Digital signature or EVC (electronic verification code)

- Photographs of the applicant and authorized signatories

- Constitution of business (such as partnership deed, memorandum of association, etc.)

- Authorised signatories must have a letter of authority or a board decision.

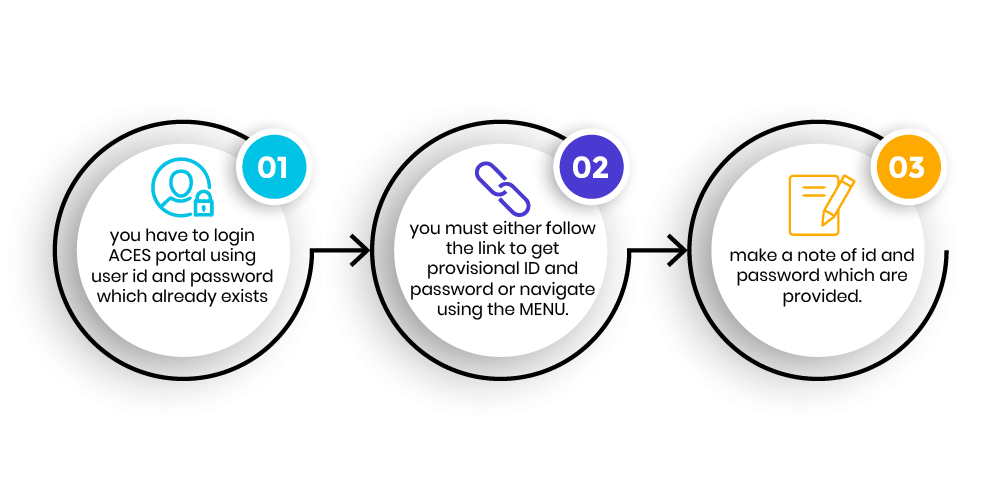

A GST certificate is a document that serves as proof of registration under GST. It contains details such as your GSTIN (GST identification number), legal name, trade name, address, date of registration, etc. You can download your GST certificate from the GST portal by following these steps:

- Enter your GST portal username and password

- Navigate to Services > User Services > View/get Certificate

- To get your certificate in PDF format, click the Download button.

The turnover limit of GST is the maximum amount of aggregate turnover that a person can have in a financial year without being liable to register for GST. The turnover limit of GST varies depending on the type and location of the business entity. The current turnover limit of GST is as follows:

- Rs. 20 lakhs for normal category states (except Jammu and Kashmir)

- Rs. 10 lakhs for hill states and special category states (Arunachal Pradesh, Assam, Himachal Pradesh, Jammu and Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Uttarakhand).

- - Rs. 40 lakhs for exclusive suppliers of goods (except those who are required to register under other provisions of GST law).

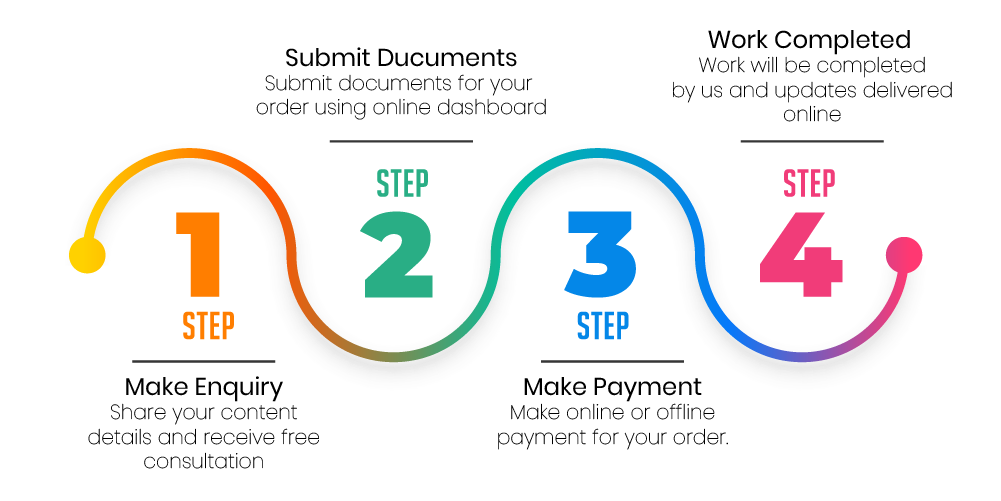

Fill Up Application Form

Make Online Payment

Executive will Process Application

Get Confirmation on Mail

What Our Clients Say

associated with