Msme Registration online

MSME/SSI Registration is mandatory for small business entities. It will help them in availing subsidies, incentives, concessional rate loans and other registration benefits offered by the government. The eligibility criteria to obtain the MSME/Udyam/Udyog Aadhaar registration certificate differs on the basis of the investment in plant and machinery..

Package Inclusions:-

- On phone discussion about a registration

- Application fill

- Turnaround time 2 Working days.

Enjoy great benefits and subsidies by registering your business as an MSME

We collect all the basic details

Step 1

We ask you to submit the supporting documents

Step 2

We get you your MSME registration certificate

Step 3

What Is Msme Registration?

MSME registration stands for the micro small and medium enterprises registration. THE Government of India launched MSME act to support the MSME through various schemes, incentives and subsidies. The Ministry of Micro, Small and Medium Enterprises, a branch of government of India. Banks provides loans at lower rate of interests with MSME registration. In country’s economic growth MSME play an important role.

Benefits Of Msme/ssi Registration

Benefits of MSME/SSI registration are as follows:

-

Cheaper infrastructure: For MSME/SSI registered company charges are very lower.

-

Pre-defined object or period: A partnership can be formed within a specified period or to complete a specific project or object. Once the same is completed, the partnership will automatically stand dissolved.

-

Quicker approvals from state and central government bodies: Business which are registered under MSME/SSI get higher preference.

-

Access to tenders: This is one of the benefits in which the various government tenders open to MSME/SSI to promote small business in India.

-

MSME market development assistance for micro and small enterprises: this is another important benefit given in which the government has promised to buy products from these MSMEs.

-

Cheaper bank loans: MSME/SSI registered company get lowerrate of interest on loan.

-

Easy access to credit : This is the another benefits which provides loans to MSME/SSI without collaterals. PM modi provides or introduced the mudhra loan scheme which is very beneficial.

-

Concession in trademark registration.

-

Concession in patent registration.

Who all are Eligible for MSME Registration?

The Below-mentioned entities are eligible for MSME Registration-

All the micro, small and medium level business entities falling in the prescribed parameter, can apply for MSME registration in India. Apart from Micro, small, and medium level enterprises-

-

Public companies can also apply for MSME registration.

Also, if the Company is in the manufacturing or the service sector can go for MSME Registration. Any entity having a valid Aadhar Number can apply for MSME Registration. As Aadhaar Number is mandatory for issuance of MSME Certificate.

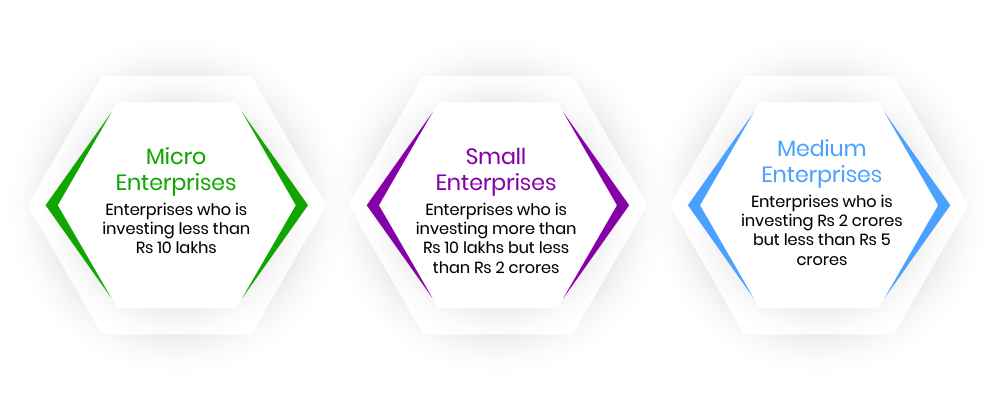

What Businesses Are Categorised Under The Msme Scheme?

For Manufacturing Sector Amount Invested In Assests

For Service Sector Amount Invested In Equipments

Document Required

For MSME registration requires few documents, details about the individual, personal details. Aadhar Card is compulsory in the registration of MSME.

The following are the documents required for the registration process.

- Aadhar number of the applicant

- Bank account number and IFSC code

- The basic business activity of the enterprise

- NIC 2 digit code Investment in plant and machinery/equipment

- MOA and AOA

- Copies of Sales Bill and Purchase Bill

- Name, gender, PAN number, email id and mobile number of the applicant.

- PAN, location, and address of the organization.

- A number of employees and the date, you are planning to start your business.

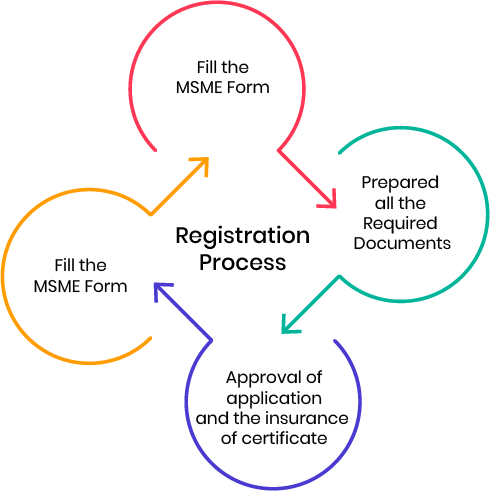

Registration Process

-

Fill Application Form: This is first step in which you have to fill necessary documents or details related to the individual or business.

-

Enter Personal Details: In this step you have to fill all your personal details such as name, address, bank account details, pan card.

-

Executive Will Process Application: In this step, executive will review your application. If there is any error ,will be notified soon.

-

Receive Certificate of Mail: In this step ,after filing the complete form you will get the certificate for MSME Registration. You will get the virtual certificate for MSME Registration as the Ministry will not issue you any hardcopy for it.

How can an Applicant Check MSME Registration Status?

An applicant can check the MSME Registration status by reference number and name by following the below-mentioned steps-

-

Step-1 To check the status, an applicant can visit the MSME Registration portal.

-

Step-2 Enter 12-digit UAM number followed by a verification code as mentioned in the Captcha image.

-

Step-3 After entering the 12-digit UAM number, click on the ‘Verify’ button.

-

Step-4 An applicant can check the status of MSME Registration.

FAQ's

- Aadhar number of the applicant

- Bank account number and IFSC code

- The basic business activity of the enterprise

- NIC 2 digit code Investment in plant and machinery/equipment

- MOA and AOA

- Copies of Sales Bill and Purchase Bill

- Name, gender, PAN number, email id and mobile number of the applicant.

- PAN, location, and address of the organization.

- A number of employees and the date, you are planning to start your business.

- Cheaper infrastructure

- Quicker approvals from state and central government bodies

- Access to tenders.

- MSME market development assistance for micro and small enterprises Cheaper bank loans

- Easy access to credit.

- Concession in trademark registration.

- Concession in patent registration.

For Manufacturing Sector Amount Invested In Assests

-

Micro enterprises-Enterprises who is investing less than Rs 25 lakhs in assets.

-

Small enterprises-Enterprises who is investing between Rs 25 lakhs and Rs 5 cr in assets.

-

Medium enterprises-Enterprises investing between Rs 5 crores and Rs 10 crores in assets.

For Service Sector Amount Invested In Equipments

-

Micro enterprises-Enterprises who is investing less than Rs 10 lakhs

-

Small enterprises-Enterprises who is investing more than Rs 10 lakhs but less than Rs 2 crores

-

Medium enterprises-Enterprises who is investing Rs 2 crores but less than Rs 5 crores.

Fill Up Application Form

Make Online Payment

Executive will Process Application

Get Confirmation on Mail

What Our Clients Say

associated with